Posted in Ethics & Compliance

Recent Posts

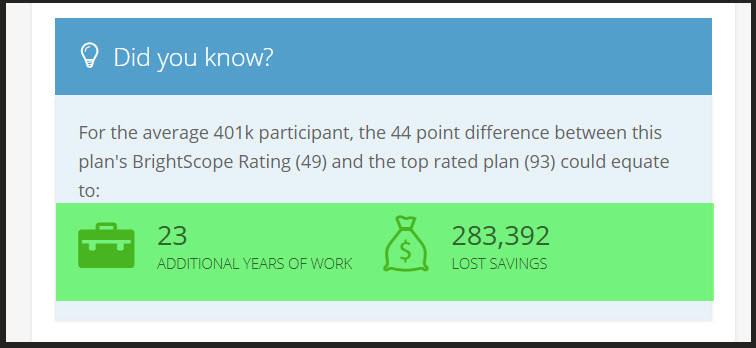

- Protected: Plundering your 401k… Are Recordkeepers Ripping you off? April 23, 2024

- Protected: https://fiduciaryfactor.com/anderson-v-principal-life/ April 23, 2024

- Are you entering an apocalypse with your 401k savings? April 23, 2024

- Protected: Yelp reviews on Principal… it’s not good!! April 23, 2024

- Is a disaster looming for Principal? April 23, 2024

Follow me on Twitter

My TweetsCopyright © 2024 Fiduciaryfactor.com